Business Vehicle Depreciation 2024 Rate – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . Many Americans have put off buying a new sport utility vehicle or truck because of steep prices and high interest rates. Now, however, may be the right time to upgrade that older model, industry .

Business Vehicle Depreciation 2024 Rate

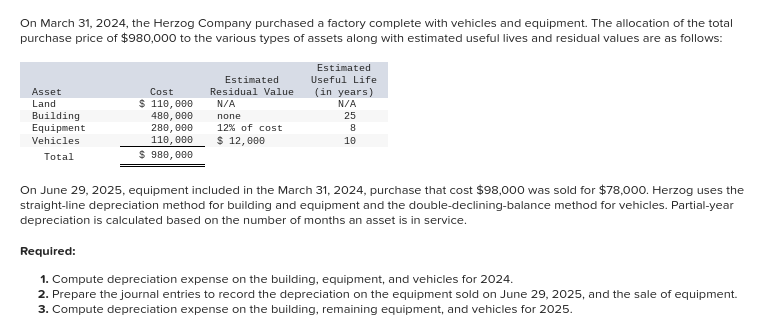

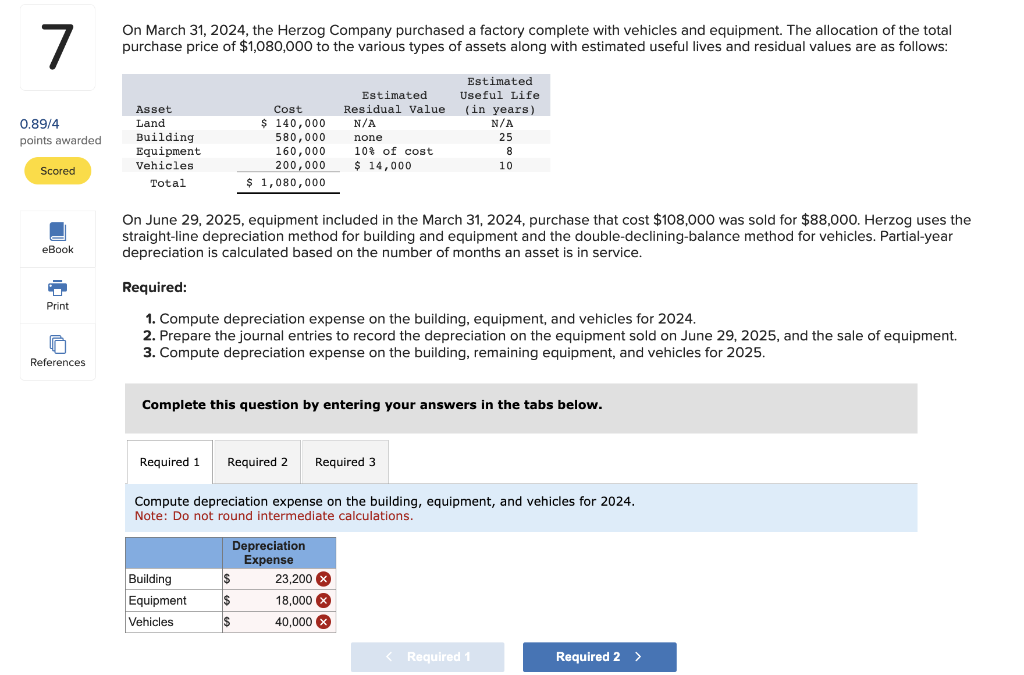

Source : www.jeep.comSolved On March 31, 2024, the Herzog Company purchased a | Chegg.com

Source : www.chegg.com2024 IRS Mileage Rate: What Businesses Need to Know

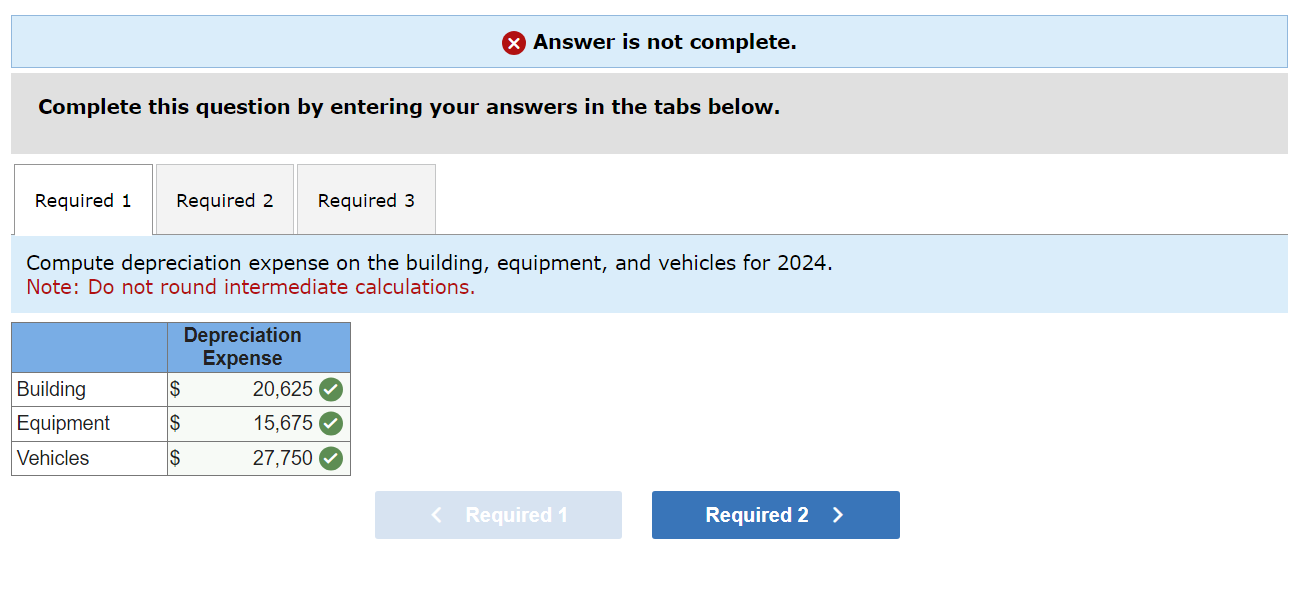

Source : www.motus.comSolved On March 31, 2024, the Herzog Company purchased a | Chegg.com

Source : www.chegg.com2024 IRS Mileage Rate: What Businesses Need to Know

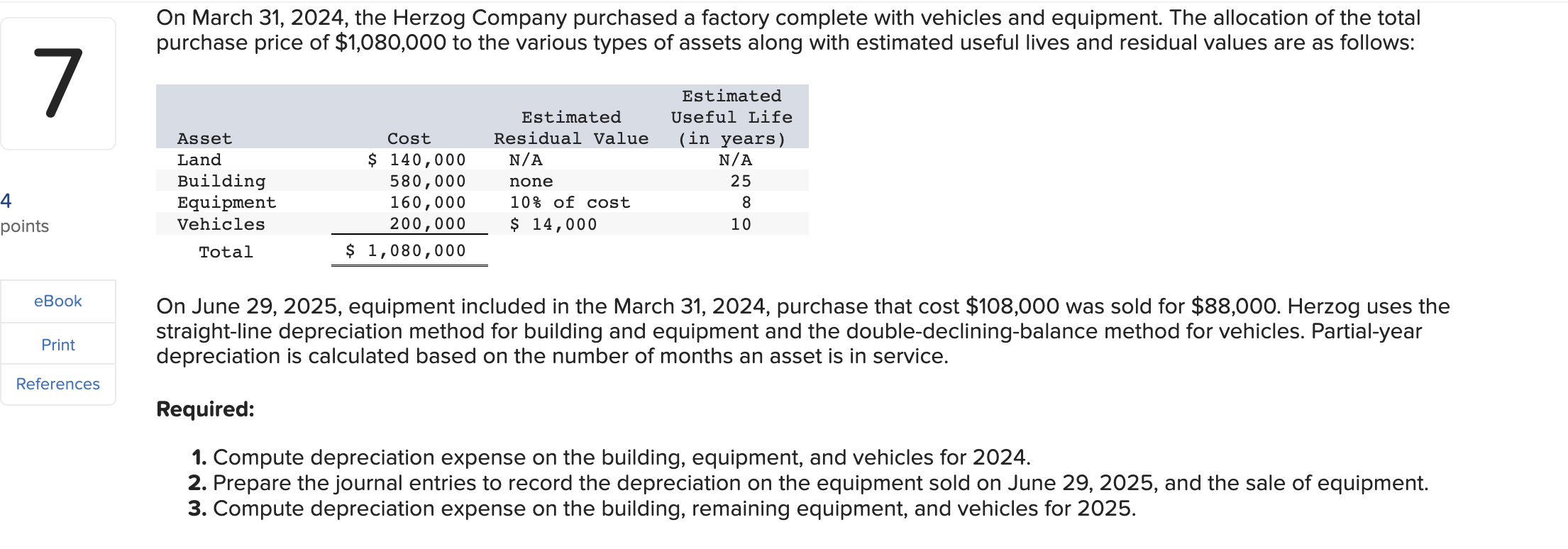

Source : www.motus.comSolved On March 31,2024 , the Herzog Company purchased a | Chegg.com

Source : www.chegg.comAnswered: On March 31, 2024, the Herzog Company… | bartleby

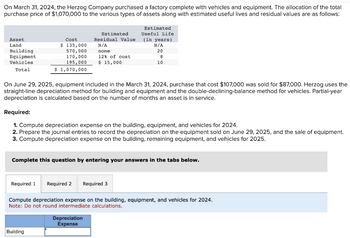

Source : www.bartleby.comSolved On March 31, 2024, the Herzog Company purchased a | Chegg.com

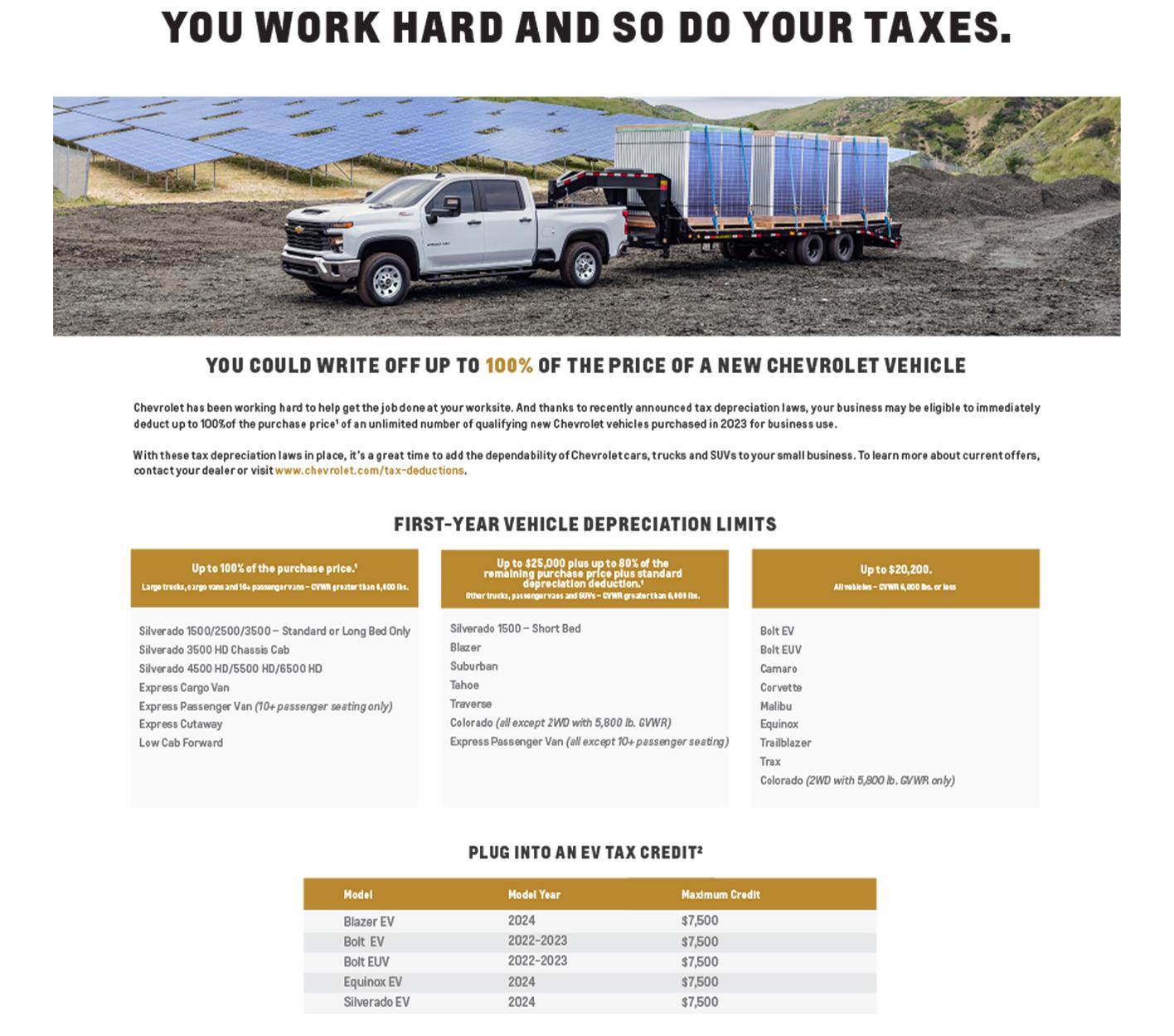

Source : www.chegg.comColussy Chevrolet is a BRIDGEVILLE Chevrolet dealer and a new car

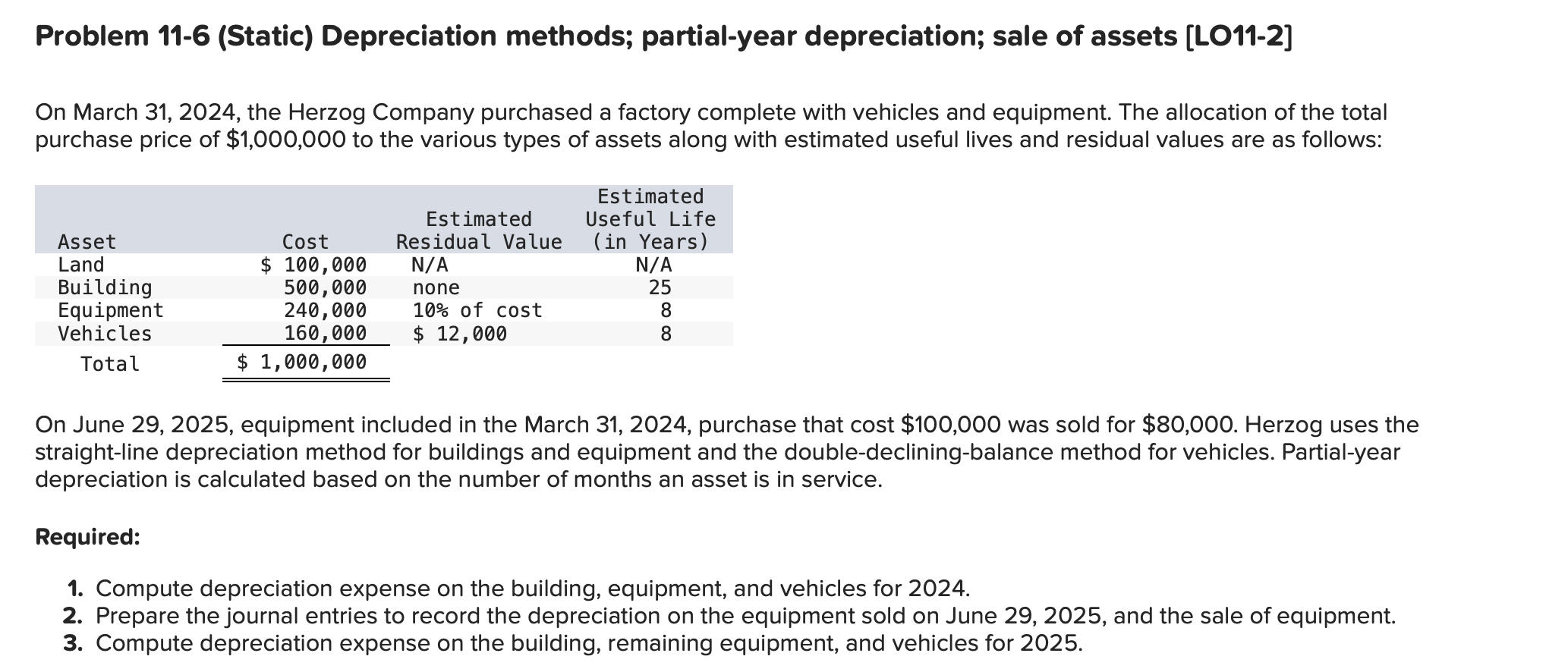

Source : www.colussy.comSolved Problem 11 6 (Static) Depreciation methods; | Chegg.com

Source : www.chegg.comBusiness Vehicle Depreciation 2024 Rate Tax Benefits For Your Small Business With Jeep® Vehicles: However, you won’t benefit from an additional tax deduction if your business already has a tax loss for a given year. Depreciation formula: 2 x (Single-line depreciation rate) x (Book value at . As car prices have climbed in recent “Auto insurance has become an unprofitable business for most companies.” Despite the forces pushing rates up, the pace of increases is expected to .

]]>