2024 Schedule A Deductions Not – Schedule A is for itemized personal deductions. As of 2011 to the cost of the goods you sell must be deducted that way, not as a separate expense. A graduate of Oberlin College, Fraser . As federal student loan payments resume for over 28 million borrowers post-pandemic, a silver lining emerges in the form of potential tax savings through the student loan interest deduction (SLID). .

2024 Schedule A Deductions Not

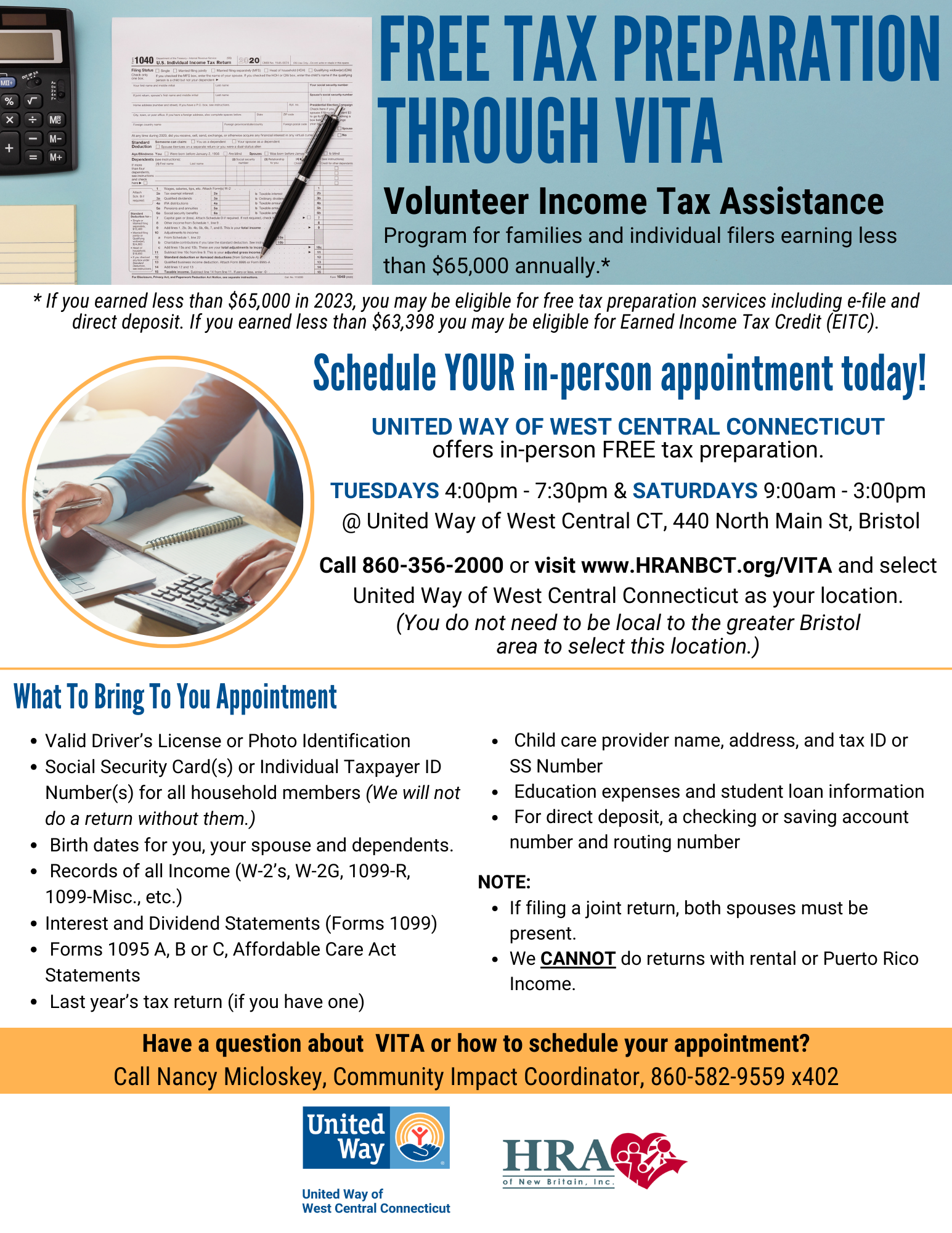

Source : www.uwwestcentralct.orgTax Advantages | IAble

Source : www.iable.govPro Financial Tax Services LLC | Oklahoma City OK

Source : www.facebook.comEmployee Benefits | Thurston County

Source : www.thurstoncountywa.govKeystone CPA, Inc. | Fullerton CA

Source : www.facebook.com2024 Tax Update and What to Expect

Source : sourceadvisors.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comFlexible Spending Accounts 2024 | Beverly, MA

Source : www.beverlyma.govDeductions in 2024:What Can & cannot be deducted from an Employees

Source : www.eventbrite.comZ5 Marketing

Source : m.facebook.com2024 Schedule A Deductions Not Free Tax Preparation Service | United Way of West Central Connecticut: Use Schedule 1 to report above-the-line You can take these deductions even if you choose not to itemize. Itemized deductions, on the other hand, are considered below the line. . However, not all homeowners can claim this tax deduction In most cases, homeowners can report the amount on this form on line 8a of Schedule A (Form 1040). However, the allowable deduction amount .

]]>