1040 Schedule E 2024 Tax – This is all you need to know. The IRS Tax Refund Calendar for 2024 outlines the key dates for tax return processing, providing clarity to taxpayers. For electronic filers, refunds are typically . As federal student loan payments resume for over 28 million borrowers post-pandemic, a silver lining emerges in the form of potential tax savings through the student loan interest deduction (SLID). .

1040 Schedule E 2024 Tax

Source : www.turbotenant.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

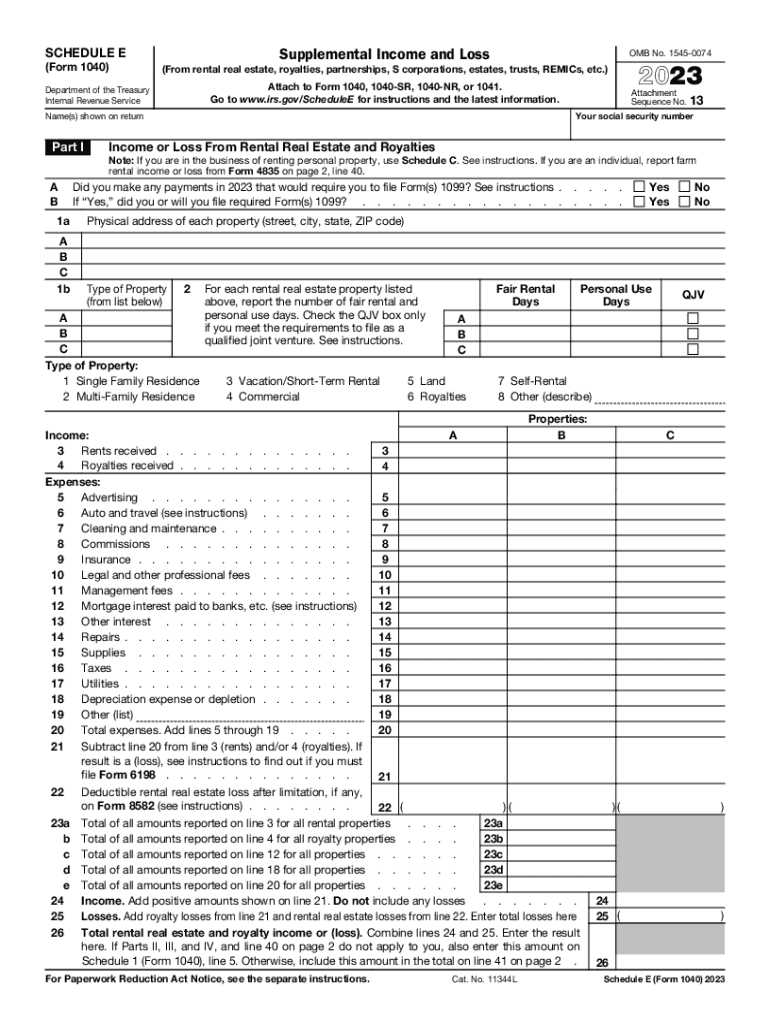

Source : thecollegeinvestor.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comIRS Schedule E (1040 form) | pdfFiller

Source : www.pdffiller.comIRS to Launch Free E Filing Program in 2024. Here’s What to Know

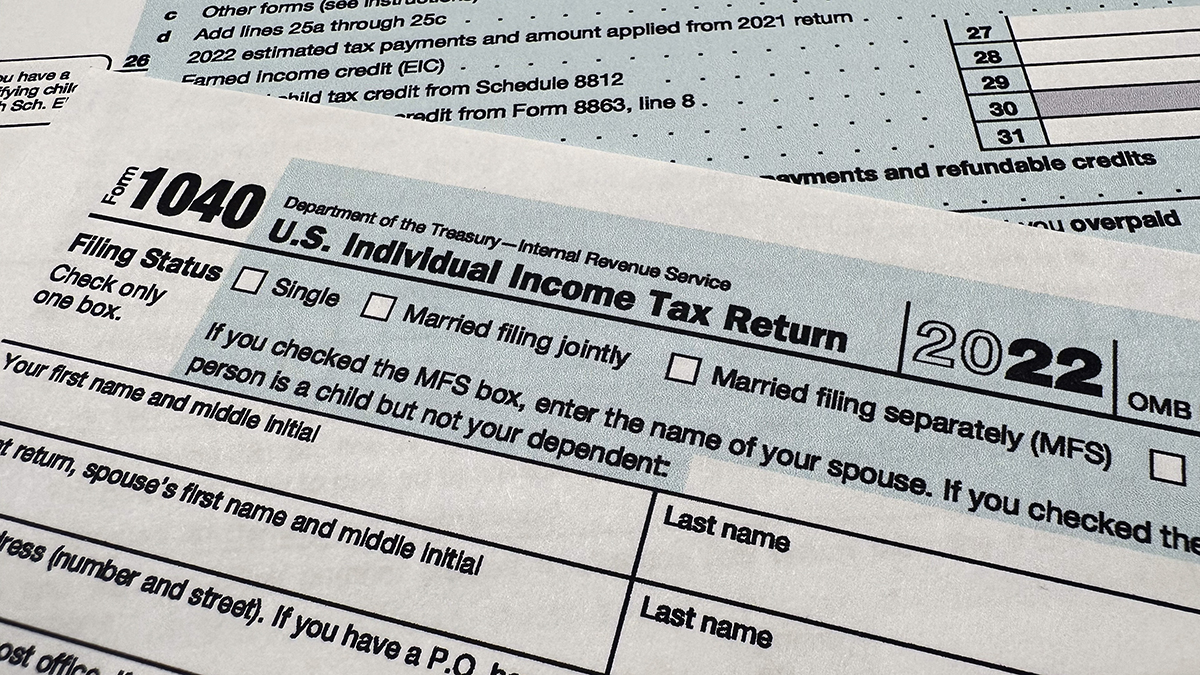

Source : www.nbcboston.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.greatland.com2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.comTax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com1040 Schedule E 2024 Tax Mastering Schedule E: Tax Filing for Landlords Explained: Tax season– with its homeowner receive from your lender in early 2024. You can then enter the amount from Line 1 on that Form 1098 into Line 8 of 1040 Schedule A. You can buy mortgage points . With tax season officially underway, many will undoubtedly be gathering what they need to file, but how can you know which forms you’ll need to submit? .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)